The 5 Essential Steps For Getting To Market Without Wasting Precious Resources

Recently, a long-time colleague, the chief sales officer for a $21M technology company, reached out to catch up and asked for help to get to market in the primary vertical where I focus. He went on to share that his company made an initial go-to-market attempt by assigning a sales rep because of their familiarity with the product. He then admitted a modest return on their investment and a residual lack of knowledge of the industry, few connections, little brand recognition, or sales results. Fast-forwarding to today, he expressed urgency to relaunch with a short game to start generating revenue quickly and a long-term plan to establish themselves in the space.

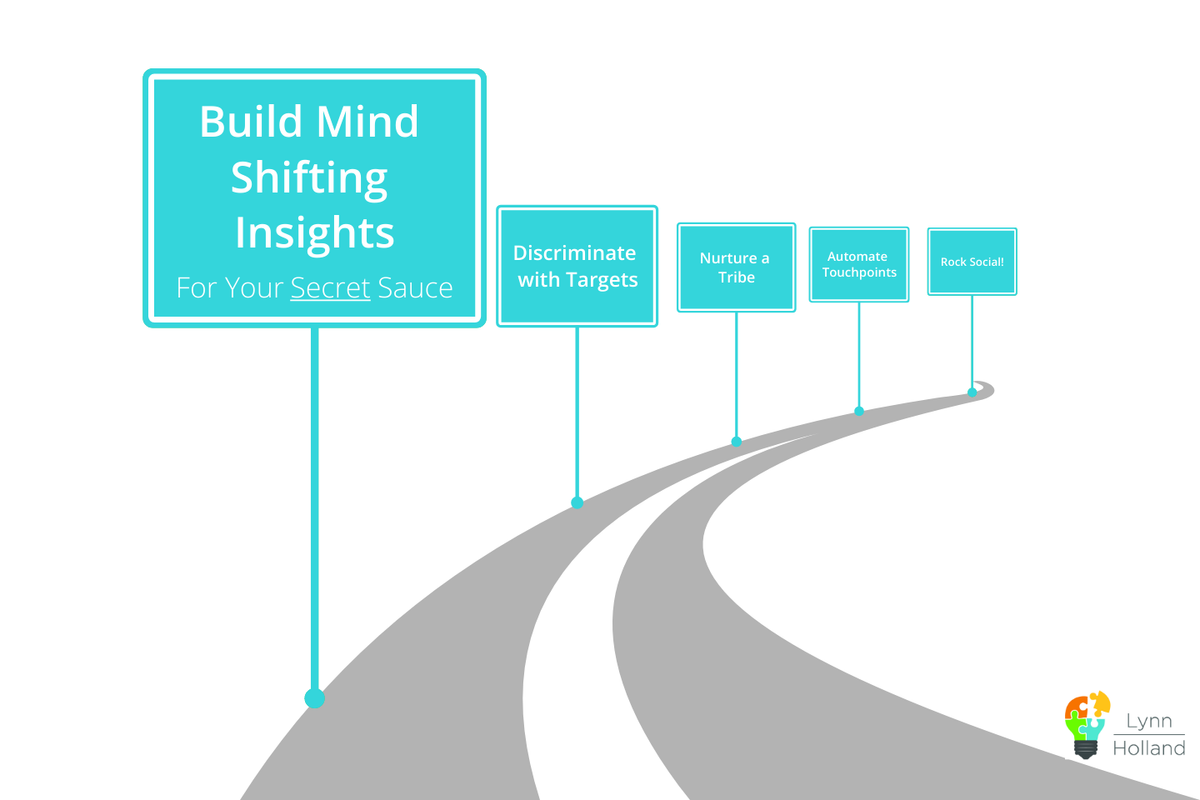

For everyone who needs to crush a go-to-market with a new brand, a product line extension, or a new vertical, you need speed to market, the right audience, and well-placed efforts to avoid wasting precious time and resources. Here are (5) of the essential steps that I think of as stops along the road to an effective plan to entrench your brand, incite change, and deliver measurable sales results while catering to a new buyer consciousness and decision-by-committee buying process.

We’ll assume of course that the product and business have been vetted with a well-substantiated business plan to address market opportunity, competition, trends, risks, contingencies, buyer profile, pricing model, financials, and infrastructure to produce and support the product, process, and customer.

Stop #1 – Build Mind Shifting Insights

Bigstock

We all think our product is great, but a survey of chief marketing officers found that only 13% believed they could pass an ultimate differentiator test by taking the names and logos off of their commercial content, hand it over to a competitor to present to the customer, and expect that customer to find their way back to buy from them for their specific solution, outcome, or benefit.

A further challenge to profitable, sizeable sales opportunities in the present-day multiple stakeholder buying journey is the 38% of sales cycles that end with the buying group deciding not to decide. Research reveals the following about the modern buying cycle*:

- Average buying group - 11 diverse, cross-functional people

- Average buying cycle - 4-5 months to investigate, gather info, evaluate, issue RFPs, demo, re-demo, and deliberate

- Typical staff hours per buying cycle - 85-90 hours or more

- Frequency of solution purchase attempts that end in choosing not to choose - 38%

Translating this to the back of a napkin assuming a sales executive works on 60 sales opportunities in a year:

- 15 Opportunities/Qtr x 38% = 20 Opportunities/Yr x an Average of 10 Hours = 1 Month/Yr.

The numbers are devastating if we’re losing 4 out of 10 times to the status quo, independent of being commoditized and losing to a competitor. So how do we beat these odds and gain back lost and unproductive time and resources?

- Teach our buyers something new that they wouldn’t have discovered on their own

- Challenge the way they see their business

- Give them a compelling reason to take action and press into change rather than commoditize our product and their decision down to the lowest cost or risk or choose to do nothing

How? We shape our brand, message, targets, tools, and strategy by mining for understanding. Understanding our customer's business, industry, business environment, and the distinguishing value of our product to form the customer’s journey as we offer deep commercial insights, create change, and differentiate ourselves from our competitors.

Stop #2 – Discriminate When Picking Targets

Bigstock

No really, this kind of discrimination is ok. Just as it is hard to strip the complex down to the simple, it is counter-intuitive to throw out a smaller net to catch more fish. Two litmus tests will put us over our target to selectively invest precious resources and time on opportunities with the greatest likelihood to convert.

1. The last two years have shaken up the organizations, industries, and regions that are thriving or surviving. This means a previously good prospect may not be in a position to make decisions or spend today. The imperative is to research and segment to avoid opportunities that are going nowhere. Going back to the data subsequent COVID-19, companies seem to fall into three categories:

- 10% - In a growth mode (i.e., consumer products, video conferencing, PPP, ventilation systems)

- 30% - Business as usual with some cost reduction measures

- 60% - In slow motion, struggling to operate with heavy scrutiny on spending

Do the research. Where does your potential customer base fall? Rather than potentially writing off the 60% and miss meeting your numbers, dig in to uncover the hidden gems that have healthy sectors for their business or are doing a good job of pivoting their strategies to grow with a new market or product.

2. Evaluate companies to find where you can create the greatest demand and generate urgency with your insights about their business. Here are some questions to ask yourself:

- What is their status quo and behaviors that I want to change?

- What are the incorrect assumptions that they have about their business?

- What don’t they know but should about their business?

- What is the level of pain they are in by staying the same vs. adopting change? Quantify “how much” better will you make their business to substantiate that a new way is their only viable way forward.

If you can’t make a compelling case for yourself, they aren’t a good prospect.

Stop #3 – Nurture A Tribe

Bigstock

In a cultural shift, buyers now link their decision to their perception of your brand and experience as they interact with your company and product. This new consciousness looks for an easier and more enjoyable journey, shared concern for values and causes, access to a tribe to affiliate with other users as they interact with your product and brand, and they expect reciprocal loyalty with escalating rewards for their ongoing participation with your brand.

Stop #4 – Automate Touch Points

Bigstock

Smaller teams and fewer resources necessitate we plan our go-to-market and ongoing support of our community with automated touchpoints in tandem with personal touch. Creating rhythms with campaigns, multi-purposed content, and using a handful of innovative tools to support our communications with automation is essential to supplement personal interactions with our network, social media engagements, speaking events, and conferences.

Stop #5 – Rock Your Social Media

Bigstock

In a few short years, our ability to virtually network in the absence of travel and in-person events, convey volumes of information, and create seismic impact has exploded with social media. Out-of-touch, one-dimensional blog posts, reposting lackluster content produced by an uninformed marketing department, or depending on “thought leadership” as the primary strategy to stand out from competitors has no statistically measurable impact on changing buying behavior. Instead, adding to in-person opportunities with face-to-face video content, articles, and active engagements with your executives and sales leaders who teach new and compelling insights will drive credibility and motivate change. These are essential for relevance, influence, and dominance. Miss the boat and fall behind.

For additional strategies or help with your go-to-market plan, please reach out to me on LinkedIn or at lynn@solvedbyholland.com.

*Research taken from CEB Advisory Group analysis and 2012 CEB Commercial Insights Assessment

- Top 5 Skills You Need For A Career In Channel Sales - Work It Daily ›

- How To Conduct Market Segmentation To Drive Conversions - Work ... ›

- 3 Tips To Adapt Your Marketing Strategy During COVID-19 - Work It ... ›

- Cost-Cutting Measures That Occur In Different Industries - Work It Daily ›

- 5 Trends In Market Research To Watch Out For In 2024 - Work It Daily ›

Bigstock

Bigstock Bigstock

Bigstock Bigstock

Bigstock