Risk Perspectives From The Sidelines: Post-Crisis Risk Management, Business Continuity, And Personal Survival

I admire Coach K, so "March Madness" has turned into March Sadness, and the new reigning champs are our frontline essential workers. The month will be remembered as one of the saddest times on record.

Sheltered-in-place with our loved ones, many FaceTimed a family member for the last time, and others carried their torches forward, virtually reaching out to those surviving and recovering. The 2020 Olympics torch has been extinguished, every major and minor sporting event has been benched. Spring and summer concerts, theater, vacations, and holiday celebrations have been postponed or cancelled in their entirety causing financial damage to the economy too great to comprehend.

As the novel coronavirus spreads, we anxiously watch our frontline defenders endure unimaginable sadness and difficulty, as we sideliners lament, "How long?"

Ever notice that the greatest coaches in sports are also on the sidelines? But they are white-boarding and planning and figuring out in real time how to fight and win. Those leaders have compassion, energy, drive, leadership; they plan, execute, learn from near-misses and defeats, and have continuously improved their outcomes. Presence and planning is everything.

What did we do to prepare? From a business and personal risk management perspective, probably not enough.

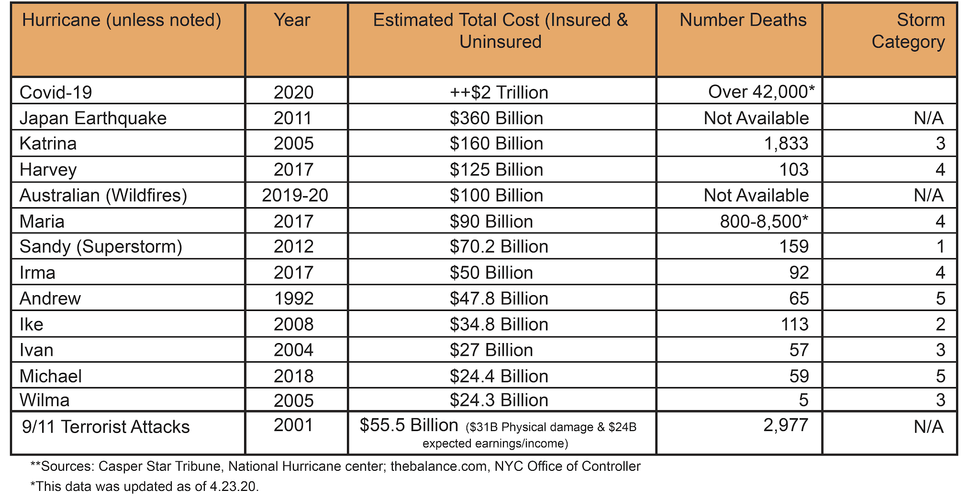

Our large, demographically diverse nation sees disasters as "once-in-a-lifetime" events, never to be repeated. Here's a snapshot of a few of our "once-in-a-lifetimes."

Disruptors

The 2011 Japan earthquake resulted in significant loss, including the Fukushima reactor meltdown, and supply chain disruption in the auto industry, auto assembly, and other third-party auto vendors in Japan.

Hospitals found saline suddenly in short supply after Hurricane Maria devastated the island of Puerto Rico, one of the largest distributors of saline bags and pharmaceuticals. Other hurricanes caused disruption in construction due to demand and availability of product (lumber, sheet metal, HVAC, etc.). And the WTC attacks were seen, in 2001, as the most significant event "ever." But then there was the "too big to fail" financial meltdown in 2008, which many in the insurance industry saw coming. And now, it appears COVID-19 has so far exceeded our worst of the worst, and we don't know when the end is in sight.

The coronavirus has finally debunked the nation's perspective that "it won't happen in my backyard" (common for those not in coastal, tornado, wildfire, or earthquake areas). That said, we must look at what we have done, and what we must do going forward to be better prepared for these "anomalies."

Organizations that have figured out survival have done a couple key things: become creative in response while honoring safety and valuing staff, and put resource plans in place for consequential events. (A colleague of mine noted over two months ago that she needed to go brush off and review her pandemic manual. Yes, they had one, it was tested, and they were able to put it in place immediately.) Much more effective and less costly than going out of business.

This is the first in a short series of considerations and recommendations to be able to manage your insurance and risk issues during and after the coronavirus.

How To Manage Your Insurance & Risk Issues After COVID-19

First: READ YOUR POLICIES and ask questions. Lots of them. Work with your agent or broker now to assess the current disruption in the insurance market (for your business, life, health, benefits, and your home and personal lines). There will be a significant amount of litigation (similar to 9/11) related to insurer bad faith due to vague policy language.

Expect that your insurance rates may increase, but don't be afraid to ask why. Now might not be a time to "shop" your insurance, since insurers do reward loyalty and this year there are additional incentives. (Allstate, American Family, Farmers, Hanover Insurance, Liberty Mutual, MetLife Auto & Home, Nationwide, State Farm, Travelers, and USAA have all indicated they will be providing some form of premium relief or reduction on personal policies, and Progressive will also include some business clients.)

Second: There is plenty of discussion around whether existing property policies have business interruption coverage, and the insurance companies appear somewhat unified. If a business did not have any "direct physical damage," then the coverage likely does not apply for standard property policies.

Some insurers who write specialized programs and institutions, like higher ed or hospitals, may have some coverage carved into their forms. Ask anyway. Find out if it will be excluded on your renewal.

If you have the opportunity to "buy back," what are the significant terms and restrictions related to that coverage? Large organizations are re-considering use of their captives to embed this coverage and fund these items within their owned captive insurance companies. This will require substantive discussions with finance and actuarial resources to ensure you have the cash flow to pay applicable premiums into the captive.

Third: How will your business's health insurance be impacted by COVID-19? Since health insurers never priced in their actuarial models a pandemic, I suspect the costs will have to be recouped, and I doubt the federal government has a stash waiting to pay for this additional expense.

With your rates going up, can your employees afford any plan given recent layoffs?

Fourth: Workers' compensation may be one of the most significant impacts on your business, so you should spend an equal amount of time assessing pre- and post-risk. How will you re-open? Will you continue to offer working from home for those who request?

OSHA has issued guidance on handling COVID-19 related workplace operations. Implementation and consistency in managing these guidelines could positively, or negatively, impact the revival of your business.

Fifth: How secure is your working from home environment? Have you pre-planned VPNs, regular testing of remote sites, and the security of confidential documents both online and paper?

If your 9-year-old inadvertently includes a confidential document sitting on your coffee table while she records on TikTok, did a new trade secret just get announced to the internet?

Bottom line: We've had multibillion-dollar crises before, and we have reacted after each one. The number of deaths and amount of destruction suffered from failing to aggressively plan resulted in additional failures, loss of income, and loss of life down the road. The "new normal" is not normal, and we must be able to lead through this disruption time with conscious and thoughtful planning.

Start the conversation and questions now.

Listen To The Podcast Episode...

Next up: Employment law (discrimination), Workers Compensation, HIPAA, and Privacy Rules, now and post COVID-19.

Looking for a job? We can help! Join our career growth club today and get access to one-on-one career coaching, resume and cover letter reviews, online tutorials, and unlimited networking opportunities—all in your back pocket!

If you want FREE career advice in your inbox, subscribe to our newsletter The Daily Dose!

- 7 Tips For Becoming A Successful Leader At Work ›

- JT Talks Jobs - Neutral Thinking In Times Of Crisis With Trevor ... ›

- 3 Ways Business Leaders Can Manage Through Chaos - Work It ... ›

- How Leaders Can Successfully Manage Through A Crisis - Work It Daily | Where Careers Go To Grow ›

- 4 Ways To Implement Root Cause Analysis Procedures - Work It Daily | Where Careers Go To Grow ›

- 4 Ways To Implement Root Cause Analysis Procedures - Work It Daily | Where Careers Go To Grow ›

- The Kind Of Person Who Fails In Your Industry (And Why) - Work It Daily | Where Careers Go To Grow ›

- 3 Things Employers Should Focus On After COVID-19 - Work It Daily ›

Bigstock

Bigstock Bigstock

Bigstock Bigstock

Bigstock